Mr. Robins is a regular columnist on bankruptcy law for the Suffolk Lawyer (the official publication of the Suffolk County Bar Association) where he has written for over 18 years. He also frequently writes articles for the Nassau Lawyer (the official publication of the Nassau County Bar Association), as well as the Attorney of Nassau.

He has covered a variety of topics including New York bankruptcy law and procedure; bankruptcy legislation; the new bankruptcy laws; Long Island bankruptcy practice; the interaction of bankruptcy law on personal injury cases; bankruptcy and matrimonial rights; issues in bankruptcy court including the meeting of creditors, bankruptcy motions, adversary proceedings and bankruptcy litigation; profiles on bankruptcy court judges; tax consequences of filing for bankruptcy; bankruptcy issues with sub-prime mortgages; and re-establishing credit after bankruptcy.

|

Full Story »  | Consumer Bankruptcy - Non-Resident Spouse Permitted to Avoid Judgment Lien with Wildcard

Legal Brief, September 2021

Written by Craig D. Robins, Esq.

If writing the most number of decisions on lien avoidance was an Olympic sport, Chief Bankruptcy Judge Alan S. Trust would surely win the gold medal. The Central Islip Judge just issued his umpteenth decision on the subject...

Full Story »

|

|

Full Story »  | Chap 13 Debtor Got More than She Bargained For

Suffolk Lawyer, June 2021

Written by Craig D. Robins, Esq.

For quite some time, consumer bankruptcy practitioners in our district have suggested to some clients with mortgage arrears that they consider seeking Chapter 13 relief combined with an application for loss mitigation.

Full Story »

|

|

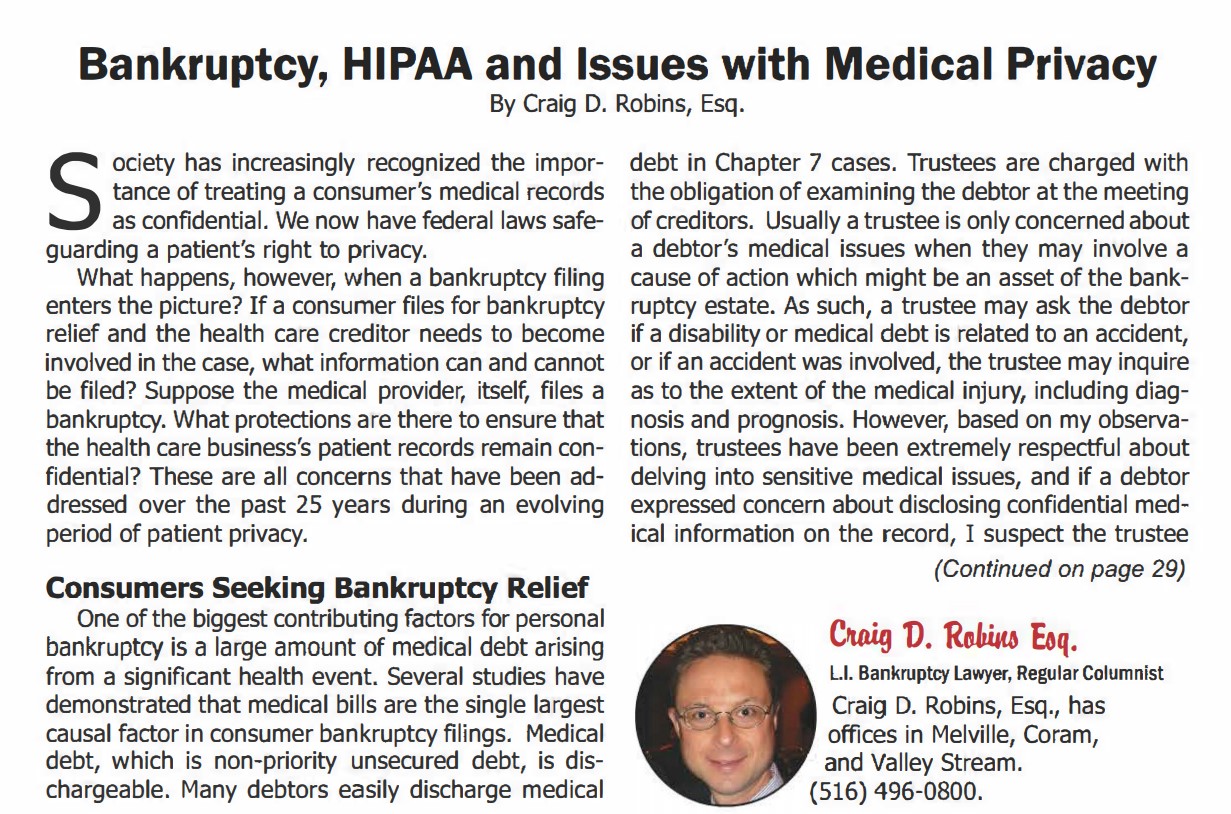

Full Story »  | Bankruptcy, HIPAA and Issues with Medical Privacy

Suffolk Lawyer, April 2021

Written by Craig D. Robins, Esq.

Society has increasingly recognized the importance of treating a consumer's medical records as confidential. We now have federal laws safe-guarding a patient's right to privacy

Full Story »

|

|

Full Story »  | Bankruptcy Judge Stan Bernstein, 79, Passes Away from Covid-19

Suffolk Lawyer, February 2021

Written by Craig D. Robins, Esq.

Stan B. Bernstein, who sat in the Central Islip Bankruptcy Court from 1996 to 2007, passed away on December 26, 2020 in Atlanta due to complications from Covid-19. Judge Bernstein, who had presided over thousands of consumer and business bankruptcy cases on Long Island, was especially fond of informally talking to those attorneys who appeared before him about non-bankruptcy matters, and was well-liked.

Full Story »

|

|

Full Story »  | Chief Bankruptcy Judge Alan S. Trust Steers Court into the

Post-Pandemic World

Suffolk Lawyer, December 2020

Written by Craig D. Robins, Esq.

Last month I profiled Judge Alan S. Trust

who was sworn in as Chief Bankruptcy Judge

for the Eastern District of New York in October. This month I will highlight some of the

judge’s plans for operating the court during

these unsettled times, as well as his tips for

practicing in a Covid world, based on a recent interview

Full Story »

|

|

Full Story »  | The ‘Snapshot Rule’ Locks in the Homestead Exemption at the Time of Filing

Suffolk Lawyer, October 2020

Written by Craig D. Robins, Esq.

Suppose a typical consumer who owns a

home seeks Chapter 7 bankruptcy relief but

wants to sell the home immediately after filing.

Can the trustee argue that the debtor is

no longer entitled to utilize the homestead

exemption because the debtor does not intend

to keep the home?

Full Story »

|

|

Full Story »  | “I Surrender” Does Not Mean I Surrender — Mortgagee Can’t Hold

Statement of Intention Against Debtor in Foreclosure Case

Suffolk Lawyer, September 2020

Written by Craig D. Robins, Esq.

In my November 2017 column, “‘I Surrender!’

What Does That Mean?,” I discussed

the situation where a Chapter 7 consumer

debtor declares in the “Statement of Intention”

schedule to the petition, his or her intention

to surrender their home, and what that

declaration actually means.

Full Story »

|

|

Full Story »  | Bankruptcy and Foreclosure Practice Under COVID-19 and the Coronavirus CARES Act - Important Updates on Bankruptcy and Foreclosure Matters

Suffolk Lawyer, April 2020

Written by Craig D. Robins, Esq.

We are all grappling with how to comprehend

the impact of COVID-19, which will

likely transform the way we conduct our

practices for the next few years. Consumer

bankruptcy and foreclosure defense practitioners

returning to work after being sidelined

by the coronavirus pandemic will see

an impact on all aspects of their practice.

Full Story »

|

|

Full Story »  | New Subchapter V Bankruptcy for Small Business Reorganizations

Suffolk Lawyer, March 2020

Written by Craig D. Robins, Esq.

For years, bankruptcy practice has focused on the big three types of bankruptcy filings: Chapters 7, 11 and 13. As of Feb. 19, 2020, we have a new one: Chapter 5. Technically it is a Roman numeral V and it is a subchapter.

Full Story »

|

|

Full Story »  | Bankruptcy Court Strikes Mortgage on Statute of Limitations Grounds

Suffolk Lawyer, February 2020

Written by Craig D. Robins, Esq.

One of the trendiest topics in foreclosure defense these days is whether a mortgage can be stricken because of the statute of limitations. Since many foreclosure cases brought about 10 years ago were dismissed due to having been improperly filed, mortgagees have been recommencing these suits, many of which involve periods of no payments exceeding six years — the statute of limitations for collecting on a mortgage.

Full Story »

|

|

Full Story »  | Trustee Who Fails to Timely Administer Asset Loses It

Suffolk Lawyer, January 2020

Written by Craig D. Robins, Esq.

It sometimes gets monotonous for trustees at meetings of creditors. In case after case they must examine the debtors by essentially asking the same questions repeatedly. It is therefore not surprising that every now and then they may skip an important question or forget to inquire about something.

Full Story »

|

|

Full Story »  | Can Debtor Lose Discharge for Inability to Pay Trustee?

Suffolk Lawyer, December 2019

Written by Craig D. Robins, Esq.

Here is a scenario that is not at all uncommon in typical Chapter 7 consumer cases. The trustee learns that the debtor has a non-exempt asset and demands that the debtor turn it over.

Full Story »

|

|

Full Story »  | Decision Removes Uncertainty About Protecting Workers’ Comp Awards

Suffolk Lawyer, November 2019

Written by Craig D. Robins, Esq.

Up until 2011, there was a belief among consumer bankruptcy practitioners in our district that workers’ compensation benefits were totally exempt and fully protected.

Full Story »

|

|

Full Story »  | Strike One, Strike Two, Strike Three . . . You’re Out!

Suffolk Lawyer, October 2019

Written by Craig D. Robins, Esq.

In the past six months, Judge Alan S. Trust, sitting in the Central Islip Bankruptcy Court, issued just two written opinions, yet both addressed an increasingly common application - a motion for relief from the automatic stay.

Full Story »

|

|

Full Story »  | Canine Conundrum: Exempting Doggy Insurance for Scout

Suffolk Lawyer, February 2019

Written by Craig D. Robins, Esq.

Bankruptcy courts from time to time address odd and unusual situations. Judges seem to take delight in issuing decisions involving pets. And here we have both.

Full Story »

|

|

Full Story »  | Did Santa Leave the Debtor Some Gift Cards

Suffolk Lawyer, January 2019

Written by Craig D. Robins, Esq.

Now that the holidays have just passed, it's a perfect time to discuss whether consumers can load up with gift cards before filing for bankruptcy relief, and then exempt them.

Full Story »

|

|

Full Story »  | Trustee Short Sales May Be Heading to Supreme Court

Suffolk Lawyer, October 2018

Written by Craig D. Robins, Esq.

One of the most controversial issues our bankruptcy bar is talking about is whether a Chapter 7 trustee may force a short sale.

Full Story »

|

|

Full Story »  | Motions for Reconsideration in Bankruptcy Court

Suffolk Lawyer, September 2018

Written by Craig D. Robins, Esq.

You’ve just lost a motion in Bankruptcy Court and you really want to pursue the matter further; what are your options? Obviously, one choice is to file an appeal. However, another possibility is to bring a motion for reconsideration.

Full Story »

|

|

Full Story »  | Expanding the Wedding Ring Exemption

Suffolk Lawyer, June-July 2018

Written by Craig D. Robins, Esq.

When many of us more seasoned bankruptcy attorneys started practicing several decades ago, there seemed to be an unspoken understanding in our district that trustees would not go after wedding and engagement rings due to their intrinsic and sentimental value.

Full Story »

|

|

Full Story »  | Debtor Amends Exemptions to Protect Homestead 19 Years Later

Suffolk Lawyer, May 2018

Written by Craig D. Robins, Esq.

Since the Supreme Court decided Law v. Siegel in 2014, there has been a trend in which bankruptcy courts have become increasingly permissive towards debtors' efforts to use or amend their exemptions.

Full Story »

|

|

Full Story »  | 'I Surrender!' What Does That Mean?

Suffolk Lawyer, November 2017

Written by Craig D. Robins, Esq.

Exploring recent bankruptcy cases and their implications was the subject of a well–attended seminar on October 3rd, at the Nassau County Bar Association.

Full Story »

|

|

Full Story »  | Chap 13 Debtors Must Be Current at Time of Discharge

Suffolk Lawyer, September 2017

Written by Craig D. Robins, Esq.

This summer saw two decisions handed down by our judges in the Central Islip Bankruptcy Court that will make it harder for some struggling Chapter 13 debtors with Mortgages to obtain their discharges.

Full Story »

|

|

Full Story »  | Do Foreclosure Defense Issues Belong in Bankruptcy Court

Suffolk Lawyer, June 2017

Written by Craig D. Robins, Esq.

Many homeowners who have been thrust into foreclosure understandably engage in a vigorous defense in state court — primarily in an effort to delay the inevitable foreclosure sale.

Full Story »

|

|

Full Story »  | Debtor’s Attorney Sanctioned for 707(b) BAPCPA Abuse

Suffolk Lawyer, May 2017

Written by Craig D. Robins, Esq.

A controversial decision just handed down by Central Islip Bankruptcy Judge Louis A. Scarcella, which sanctioned a debtor’s attorney for failing to engage in due diligence prior to filing a typical Chapter 7 consumer petition, has already become a heated topic that the local bankruptcy bar is actively discussing.

Full Story »

|

|

Full Story »  | Demonstrating Fraud Exceptions to Discharge

Suffolk Lawyer, April 2017

Written by Craig D. Robins, Esq.

When a consumer files for Chapter 7 relief, a creditor can object to the debtor's efforts to discharge a debt under several theories of fraud. n a recent case assigned to Judge Robert E. Grossman, a debtor bonowed significant sums of money from two retirees and barely paid them back before filing for Chapter 7 relief.

Full Story »

|

|

Full Story »  | Failure to Pay Alimony Spells Doom for Debtor

Suffolk Lawyer, March 2017

Written by Craig D. Robins, Esq.

Over the past decade or so, Congress has amended various bankruptcy statutes to protect innocent spouses in matrimonial situations. T h o s e protections were at work in a recent case that Central Islip Bankruptcy Judge Louis A. Scarcella dismissed for cause, upon a motion brought by the debtor's ex-wife.

Full Story »

|

|

Full Story »  | Study Shows Disparity of Justice in Bankruptcy Court

Suffolk Lawyer, January 2017

Written by Craig D. Robins, Esq.

Bankruptcy attorneys can often be found discussing their cases with their fellow attorneys while waiting at court for their matters to be called. Upon mentioning an interesting set of facts that they are currently litigating, the first question often heard is: “Who is the judge on your case?”

Full Story »

|

|

Full Story »  | Debtor Can Protect Home He Was Ousted From

Suffolk Lawyer, September 2016

Written by Craig D. Robins, Esq.

Conventional wisdom would lead one to believe that a consumer debtor who moved out of his house prior to filing for Chapter 7 relief is not entitled to utilize the homestead exemption to protect his interest in the house.

Full Story »

|

|

Full Story »  | Court Allows Transfer to IRA on Eve of Filing

Suffolk Lawyer, June 2016

Written by Craig D. Robins, Esq.

Let's get right to the facts: Less than two weeks before filing for Chapter 7 relief, a consumer debtor empties his $44,000 bank account that he jointly holds with his wife.

Full Story »

|

|

Full Story »  | Trustee Not Permitted to Pursue Pre-Petition "Asset"

Suffolk Lawyer, May 2016

Written by Craig D. Robins, Esq.

Here's an unusual situation. Ten years after a routine Chapter 7 case was closed, the trustee sought to re-open it to pursue an undisclosed "asset" worth over a hundered thousand dollars.

Full Story »

|

|

Full Story »  | The Omitted Creditor in a Closed Bankruptcy Case

Suffolk Lawyer, January 2016

Written by Craig D. Robins, Esq.

Here's a perplexing situation that all of us bankruptcy attorneys find ourselves in from time to time. Weeks, months or years after a bankruptcy case is closed, a client calls up to say that a debt was inadvertently omitted from the filing. What do you do?

Full Story »

|

|

Full Story »  | Bankruptcy Stays and the Chapter 13 Repeat Filer

Suffolk Lawyer, October 2015

Written by Craig D. Robins, Esq.

Before Congress drastically modified the Bankruptcy Code in 2005, a number of debtors abused the bankruptcy system by filing serial Chapter 13 cases, alwasy on the eve of foreclosure, to stay the foreclosure sale.

Full Story »

|

|

|

Full Story »  | Chapter 7 Trustees Gone Wild?

Suffolk Lawyer, January 2014

Written by Craig D. Robins, Esq.

As we all know, the key role of the Chapter 7 trustee is to garner assets for the benefit of creditors. However, the vast majority of Chapter 7 eases are no-asset cases leading trustees to constantly look for ways to bring money into the bankruptcy estate.

Full Story »

|

|

|

Full Story »  | New Test for Re-Opening Case to Add P.I. Suits

Suffolk Lawyer, December 2013

Written by Craig D. Robins, Esq.

Although debtors sometimes forget to schedule assets, trustees devote a substantial amount of attention to searching, in particular, for personal injury actions that debtors inadvertently omit.

Full Story »

|

|

|

Full Story »  | HOA Dues in Bankruptcy Cases - Debts Not Treated Like Ordinary Debt

Suffolk Lawyer, November 2013

Written by Craig D. Robins, Esq.

Consumers who own co-ops and condos have monthly obligations to a homeowner's or community association. What happens when a consumer seeks bankruptcy relief? Can the consumer discharge HOA dues?

Full Story »

|

|

|

Full Story »  | Bankruptcy Attorney Pays Price For Vexatious Litigation

Suffolk Lawyer, October 2013

Written by Craig D. Robins, Esq.

A recent court decision brought back a memory of an odd discussion I had with an attorney in the hallway of the bankruptcy court a good number of years ago. He was there to defend a Chapter 13 trustee's motion to dismiss and boasted to me that he was not worried about losing, as he planned to "paper the trustee to death" with an extraordinary amount of litigation.

Full Story »

|

|

|

Full Story »  | Victory for Chap 13 Debtors Seeking Mort Mods

Suffolk Lawyer, September 2013

Written by Craig D. Robins, Esq.

Consumer debtors in Chapter 13 cases are required to pledge all of their disposable income to the plan. But what happens after confirmation when the debtor is successful in obtaining a mortgage modification that results in lower monthly payments?

Full Story »

|

|

|

Full Story »  | Avoiding judgment liens when only one spouse files

Suffolk Lawyer, June 2013

Written by Craig D. Robins, Esq.

When a homeowner seeks bankruptcy relief, one of the great benefits of bankruptcy is the ability to avoid and eliminate judicial liens, provided that certain conditions are met. This is a concept I've written about previously.

Full Story »

|

|

|

Full Story »  | Do Bankruptcy Laws Encourage Debtors to Smoke?

Suffolk Lawyer, April 2013

Written by Craig D. Robins, Esq.

"Although staunchly opposed to smoking, I'm continually intrigued by the amount of money some of my consumer bankruptcy clients spend to maintain their unhealthy tobacco habit."

Full Story »

|

|

|

Full Story »  | Discharging Christmas Gift Purchases in Bankruptcy

Suffolk Lawyer, February 2013

Written by Craig D. Robins, Esq.

Bankruptcy attorneys often get busy towards the end of Jan. each year as consumers, having just finished their family holiday obligations, receive a new round of ever-increasing credit card bills, compelling them to seek bankruptcy advice.

Full Story »

|

|

|

Full Story »  | Is Another Wave of Bankruptcy Reform Ahead?

Suffolk Lawyer, January 2013

Written by Craig D. Robins, Esq.

For eight years leading up to 2005, the banking and credit card industries lobbied Congress incessantly, urging them to believe that American consumers who sought bankruptcy relief were essentially deadbeats.

Full Story »

|

|

|

Full Story »  | Bankruptcy Court Says $5,000 Chap 13 Fee Reasonable

Suffolk Lawyer, December 2012

Written by Craig D. Robins, Esq.

What is a reasonable legal fee for a typical Chapter 13 bankruptcy case? That issue was addressed in a decision just released by Judge Jerome Feller, a bankruptcy judge in the Eastern District of New York, sitting in the Brooklyn Bankruptcy Court.

Full Story »

|

|

|

Full Story »  | Suspended Bankruptcy Attorney and Paralegal Punished

Suffolk Lawyer, November 2012

Written by Craig D. Robins, Esq.

Non-attorney bankruptcy petition preparers can get into a heap of trouble if they do not accurately follow certain Bankruptcy Code provisions designed to protect consumer debtors.

Full Story »

|

|

|

Full Story »  | When Debtors Forget to Schedule P.I. Suits

Suffolk Lawyer, September 2012

Written by Craig D. Robins, Esq.

There is one question that Chapter 7 trustees like to ask debtors twice at the meeting of creditors: 'Are you currently suing anyone or do you have the right to sue anyone?

Full Story »

|

|

|

Full Story »  | Debtor's Attorney Tries to be Creative — Unsuccessfully

Suffolk Lawyer, June 2012

Written by Craig D. Robins, Esq.

After I wrote about some bankruptcy court decisions last month which involved some quirky and unusual facts, some of my colleagues requested that I continue to discuss similarly odd and interesting cases.

Full Story »

|

|

|

Full Story »  | Two Attorneys Get Into Serious Trouble Over E.C.F. Filings

Suffolk Lawyer, May 2012

Written by Craig D. Robins, Esq.

The following is a cautionary tale of what occurs when the uninitiated attempt to practice before the bankruptcy court without a firm grasp of the Bankruptcy Code and Federal Rules of Bankruptcy Procedure.

Full Story »

|

|

|

Full Story »  | Some Abstract Companies Don't Know Bankruptcy Law

Suffolk Lawyer, April 2012

Written by Craig D. Robins, Esq.

Every other year or so I get a frantic phone call from a former bankruptcy client or their real estate attorney, saying that there is a crisis because they are about to go to closing on the purchase or sale of real estate, and a judgment search yielded an old judgment that must be satisfied, even though the judgment creditor was scheduled in the bankruptcy case.

Full Story »

|

|

|

Full Story »  | My Clients with Second Mortgages were Brainwashed

Suffolk Lawyer, March 2012

Written by Craig D. Robins, Esq.

When I ask my clients how many mortgages they have they almost always reply that they have only one. Then, upon further questioning, they tell me they also have a home equity loan.

Full Story »

|

|

|

Full Story »  | Effect of Consumer Bankruptcy on Frequent Flyer Miles and Rewards Points

Suffolk Lawyer, February 2012

Written by Craig D. Robins, Esq.

Most consumers these days have an assortment of frequent flyer miles and credit card rewards points, whether they earn them from airlines for flying, or acquire them from banks for credit card spending.

Full Story »

|

|

|

Full Story »  | The Business Debt Exception to the Means Test

Suffolk Lawyer, December 2011

Written by Craig D. Robins, Esq.

The means test that turned six-years old last month, was intended by Congress to create an objective standard for permitting only those consumers who are not "abusing" the privileges of bankruptcy to get Chapter 7 relief.

Full Story »

|

|

|

Full Story »  | Life Estates and Remainder Interests Are Exempt

Suffolk Lawyer, November 2011

Written by Craig D. Robins, Esq.

Many senior citizens, as part of an elder law planning strategy, transfer title of their homes to their children while retaining a life estate.

Full Story »

|

|

|

Full Story »  | Bankruptcy Strategies for Assisting Foreclosure Clients

Suffolk Lawyer, October 2011

Written by Craig D. Robins, Esq.

In the past two years I've helped a great deal of clients who were either in foreclosure or who owned homes that were very much underwater.

Full Story »

|

|

|

Full Story »  | Court Revisits Tax Refund of Non-Filing Spouse

Suffolk Lawyer, September 2011

Written by Craig D. Robins, Esq.

April may be tax time for most consumers, but bankruptcy judges seem to address bankruptcy tax issues year round.

Full Story »

|

|

|

Full Story »  | Bankruptcy Trustee Gives Up Selling Former Slave's Land

Suffolk Lawyer, June 2011

Written by Craig D. Robins, Esq.

Our client, an African-American, had inherited some property 30 years ago that had been in his family for quite some time.

Full Story »

|

|

|

Full Story »  | Reaffirmation Agreements

Suffolk Lawyer, May 2011

Written by Craig D. Robins, Esq.

We've seen a year's worth of caselaw in the past four months in the Eastern District of New York regarding the retention of vehicles after bankruptcy through either reaffirmation or the assumption of lease agreements.

Full Story »

|

|

|

Full Story »  | Loss of Future Earnings Federal Bankruptcy Exemption

Suffolk Lawyer, April 2011

Written by Craig D. Robins, Esq.

Bankruptcy exemptions have been receiving a great deal of attention here in New York lately because of the recent dramatic changes to our state's exemption statutes.

Full Story »

|

|

|

Full Story »  | The New Wildcard Bankruptcy Exemption

Suffolk Lawyer, March 2011

Written by Craig D. Robins, Esq.

Last month I wrote about the surprising news that outgoing Governor Paterson unexpectedly signed legislation greatly increasing the New York State law exemptions.

Full Story »

|

|

|

Full Story »  | Gov. Paterson Unexpectedly Increases Bankruptcy Exemptions

Suffolk Lawyer, February 2011

Written by Craig D. Robins, Esq.

For New York consumers considering bankruptcy, the biggest bankruptcy news in five years dropped like a bombshell on December 23 when then-Governor Patterson unexpectedly signed legislation greatly increasing the state law exemptions.

Full Story »

|

|

|

Full Story »  | Non-Filing Spouse Keeps Tax Refund

Suffolk Lawyer, January 2011

Written by Craig D. Robins, Esq.

When it comes to post-petition tax refunds in Chapter 13 cases, the long-standing practice in this jurisdiction for debtors who propose to pay unsecured creditors less than 100% is to surrender to the trustee all tax refunds the debtor receives during the pendency of the bankruptcy case.

Full Story »

|

|

|

Full Story »  | Avoiding Judicial Liens in Chapter 13 Cases

Suffolk Lawyer, November/December 2010

Written by Craig D. Robins, Esq.

One of the extraordinary powers a consumer debtor has is the ability to avoid (eliminate) judicial liens in a bankruptcy case provided certain conditions are met.

Full Story »

|

|

|

Full Story »  | Some Debtors Have Higher Duty to Keep Records

Suffolk Lawyer, October 2010

Written by Craig D. Robins, Esq.

As a consumer bankruptcy practitioner, I am often concerned with clients who fail to have sufficient paperwork to document their past finances. This often leads to the question - at what point can a consumer debtor be in jeopardy because he or she failed to keep financial documents?

Full Story »

|

|

|

Full Story »  | Complying with the Payment Advice Rule

Suffolk Lawyer, September 2010

Written by Craig D. Robins, Esq.

We all know that under the new bankruptcy laws debtors are required to file copies of all pay stubs for income received during the 60-day period prior to filing. To put teeth into this requirement, the law further provides that failure to do so will result in the automatic dismissal of the bankruptcy case - a scary thought.

Full Story »

|

|

|

Full Story »  | Counseling High-Income Consumer Bankruptcy Debtors

Suffolk Lawyer, June 2010

Written by Craig D. Robins, Esq.

In the past few years I've noticed a fascinating trend. I'm counseling more and more debtors with high income and high debt. Representing such debtors requires addressing certain special issues which I will address in this article.

Full Story »

|

|

|

Full Story »  | The Annual NACBA Convention

Suffolk Lawyer, May 2010

Written by Craig D. Robins, Esq.

During the last week of April I traveled to San Francisco to attend the annual convention of the National Association of Consumer Bankruptcy Attorneys (NACBA).

Full Story »

|

|

|

Full Story »  | Judges Differ with Chapter 7 Cram-Down

Suffolk Lawyer, April 2010

Written by Craig D. Robins, Esq.

The December Consumer Bankruptcy Suffolk Lawyer article, "Chapter 7 Cram-Down of Second Mortgages" reported that Central Islip Bankruptcy Judge Dorothy T. Eisenberg issued a decision permitting a Chapter 7 debtor to cram-down a second mortgage.

Full Story »

|

|

|

Full Story »  | What is "Income" for Means Test Purposes?

Suffolk Lawyer, March 2010

Written by Craig D. Robins, Esq.

Last month I discussed the difficulties that Congress created by enacting a means test statute. In this month's column I will highlight some recent bankruptcy court decisions that shed light on interpreting what is "income" for means test purposes...

Full Story »

|

|

|

Full Story »  | Deciphering the Plethora of Means Test Cases

Suffolk Lawyer, February 2010

Written by Craig D. Robins, Esq.

When I sat down to write this month's column, I was prepared to discuss several recent cases interpreting the means test. However, I could not get over the great number of splits of authority over almost every single issue.

Full Story »

|

|

|

Full Story »  | Chapter 7 Cram-Down of Second Mortgages

Suffolk Lawyer, December 2009

Written by Craig D. Robins, Esq.

One of the biggest problems that homeowners face in today's recessionary economy is the loss in the value to their homes.

Full Story »

|

|

|

Full Story »  | Foreclosure Decision Sounds Warning

Suffolk Lawyer, December 2009

Written by Craig D. Robins, Esq.

Suffolk County Supreme Court Judge Jeffrey Arlen Spinner, sitting in Riverhead, just issued a highly controversial decision in a mortgage foreclosure case in which he totally cancelled the mortgage because of the mortgagee's egregious and shocking conduct in the case.

Full Story »

|

|

|

Full Story »  | Bankruptcy Issues Facing Same-Sex Couples

Suffolk Lawyer, November 2009

Written by Craig D. Robins, Esq.

Same-sex couples have many more issues to contend with than heterosexual married couples - especially when it comes to filing bankruptcy in New York.

Full Story »

|

|

|

|

Full Story »  |

Portion of New Bankruptcy Laws Declared Unconstitutional

Suffolk Lawyer, October 2008

Written by Craig D. Robins, Esq.

Discusses two recent cases which struck down that part of the new bankruptcy law which prohibited attorneys from advising clients to incur debt in contemplation of bankruptcy.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

U.S. Court of Appeals Judge Reena Raggi Visits Domus

Nassau Lawyer, October 2008

Written by Craig D. Robins, Esq.

Details United States Court of Appeals Judge Reena Raggi, who was the honoree at the 2008 annual Theodore Roosevelt Inn of Court Dinner. Craig D. Robins sits on the Board of the Inns of Court.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Litigating Against Abusive Mortgagees. Your Author Scores Big Win Against Mortagee Who Filed Frivolous Motion

Suffolk Lawyer, September 2008

Written by Craig D. Robins, Esq.

Addresses one particular case of mortgagee abuse in a Chapter 13 case in which Craig Robins represented the debtor. The mortgagee had improperly and frivolously brought a motion to vacate the stay. The article discusses Craig’s successful efforts to litigate against the mortgagee, eventually working out a settlement in which the mortgage company agreed to pay a sanction in excess of $32,000 -- a record in this jurisdiction.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

New Bankruptcy Judges Meet Bankruptcy Bar; and Former Chief Judge Jumps Firms

Suffolk Lawyer, June 2008

Written by Craig D. Robins, Esq.

Discusses information and background about the two new bankruptcy judges in the Central Islip Bankruptcy Court – Judges Alan S. Trust and Robert E. Grossman. Also contains news about former Chief Bankruptcy Judge Melanie Cyganowski's recent move to a new law firm.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

How a Debtor Should Not Act

Suffolk Lawyer, May 2008

Written by Craig D. Robins, Esq.

This article provides a summary of an interesting Texas case involving an attorney who filed his own pro se bankruptcy, and how he exercised bad faith and extremely poor judgment at almost every step of the proceeding. The article also provides some background information on the Central Islip Bankruptcy Court's newest judge, Hon. Alan S. Trust, who was sworn in the prior month.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Finally. . . U.S. Trustee Getting Tough on Mortgage Lenders: Putting a Stop to Abuse Against Consumer Debtors

Suffolk Lawyer, April 2008

Written by Craig D. Robins, Esq.

Addresses steps the United States Trustee has taken against mortgagees and their attorneys who engage in bankruptcy abuse by misrepresenting facts, filing frivolous motions, or submitting incorrect proof of claims.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Lawyers File for Bankruptcy, Too: Attorneys Are Not Immune From Debt Problems

Suffolk Lawyer, March 2008

Written by Craig D. Robins, Esq.

Discusses issues involved in representing an attorney as a client and debtor in a consumer bankruptcy case.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Voiding Pre-2005 Judgment Liens: Debtors May Use Post-2005 Homestead Exemption

Suffolk Lawyer, February 2008

Written by Craig D. Robins, Esq.

Discusses recent case that reinforces a debtor's ability to void a judgment lien under the new law if it impairs the debtor's homestead exemption.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

New Laws In Place Two Years. Panel Discusses Current Bankruptcy Practice.

Part II: Chapter 7 and Other Issues

Suffolk Lawyer, January 2008

Written by Craig D. Robins, Esq.

Continuation of previous article about various aspects of consumer bankruptcy practice under the new laws, with a focus on Chapter 7 cases.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

With New Laws In Place Two Years, Panel Discusses Current Bankruptcy Practice.

Part I: Chapter 13 Issues

Suffolk Lawyer, December 2007

Written by Craig D. Robins, Esq.

Contains a discussion of current issues in consumer bankruptcy practice under the new laws that are now two years old, with a focus on Chapter 13 issues, based on a presentation by a panel of trustees and bankruptcy lawyers at the Suffolk County Bar Association in November 2007.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

The Sub-Prime Mortgage Meltdown

Suffolk Lawyer, November 2007

Written by Craig D. Robins, Esq.

Discusses the financial crisis caused by sub-prime mortgages and presents the problem in a nutshell, including ways that consumer bankruptcy attorneys can assist their clients.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Determining Household Size for the Means Test

Suffolk Lawyer, October 2007

Written by Craig D. Robins, Esq.

Discusses ways to interpret the requirement to indicate family size on the means test considering that there are many non-traditional living arrangements.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

NY Court of Appeals Judge Robert S. Smith Visits Domus

Nassau Lawyer, October 2007

Written by Craig D. Robins, Esq.

Details New York Court of Appeals Judge Robert S. Smith, who was the honoree at the 2007 annual Theodore Roosevelt Inn of Court Dinner hosted by Craig D. Robins.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Life After Bankruptcy: Getting Credit Has Become Too Easy

Suffolk Lawyer, September 2007

Written by Craig D. Robins, Esq.

Discusses getting credit after bankruptcy, the credit rating concept, and study showing ease in obtaining post-petition credit.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

No Proof that Credit Counseling Requirement is Working

Suffolk Lawyer, June 2007

Written by Craig D. Robins, Esq.

Discusses Government Accounting Office study showing that credit counseling requirement might not be working.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Filing for Bankruptcy Does Not Create Tax Consequences

Suffolk Lawyer, May 2007

Written by Craig D. Robins, Esq.

Addresses the tax consequences of filing for bankruptcy, the concept of taxes on imputed income from debt settlement, and the exemption for tax refunds.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Keeping Track of Dollar Amounts and Key Dates in the New Law

Suffolk Lawyer, April 2007

Written by Craig D. Robins, Esq.

Discusses recent 2007 amendments to BAPCPA which change dates and dollar amounts in statute; Provides information on the most common Bankruptcy Code provisions which contain dates and amounts, to help you avoid confusion.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Proposed Attorney Discipline Program Spells Further Anxiety for Counsel

Suffolk Lawyer, March 2007

Written by Craig D. Robins, Esq.

Discusses new Attorney Disciplinary Program proposed by American Bar Association.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Judge Stan Bernstein Announces his Resignation

Suffolk Lawyer, February 2007

Written by Craig D. Robins, Esq.

Discuses Central Islip Bankruptcy Court Judge Stan Bernstein's surprise announcement of his decision to leave the bench to resume teaching law.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Chief Bankruptcy Judge Melanie Cyganowski Stepping Down

Suffolk Lawyer, January 2007

Written by Craig D. Robins, Esq.

Discusses the surprise announcement of Central Islip Bankruptcy Judge Melanie Cyganowski to retire and return to practicing law.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Best Practices for Representing Your Clients

Suffolk Lawyer, December 2006

Written by Craig D. Robins, Esq.

Discusses standards that bankruptcy attorneys should maintain in representing their clients, as set by the American College of Bankruptcy.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Bankruptcy Judges Convene to Discuss New Bankruptcy Laws on their One Year Anniversary

Suffolk Lawyer, November 2006

Written by Craig D. Robins, Esq.

Discusses recent symposium in which all bankruptcy judges in the Eastern District of New York appeared to share views of the new bankruptcy laws that are now one year old.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Recent Decision Summarizes Consumer Debtor’s Obligation to Retain Documents and Explain Pre-Petition Loss of Assets

Suffolk Lawyer, October 2006

Written by Craig D. Robins, Esq.

Discusses very interesting recent Judge Stong decision which stated that consumer debtors have a lesser responsibility to retain financial documents.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Samuel Alito Is First U.S. Supreme Court Justice to Visit Domus

Nassau Lawyer, October 2006

Written by Craig D. Robins, Esq.

Details United States Supreme Court Justice Samuel A. Alito, Jr., who was the honoree at the 2006 annual Theodore Roosevelt Inn of Court Dinner hosted by Craig D. Robins.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Random Audits of Consumer Debtors to Begin in October

Suffolk Lawyer, September 2006

Written by Craig D. Robins, Esq.

Discusses all aspects of provision in new bankruptcy law that requires random and targeted audits of consumer debtors.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

The New Bankruptcy Laws: Some Pieces are Falling Into Place

Suffolk Lawyer, June 2006

Written by Craig D. Robins, Esq.

Discusses recent Bar Association Seminar in which panelists discuss their perspectives under the 2005 Bankruptcy Act.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Matrimonial Fundamentals Under the New Bankruptcy Laws

Suffolk Lawyer, May 2006

Written by Craig D. Robins, Esq.

Discusses different types of matrimonial debts and whether they are dischargeable under the new bankruptcy laws, and reviews other aspects of matrimonial obligations as they pertain to bankruptcy proceedings.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

The New Bankruptcy Laws Continue to Be Mired in Controversy

Suffolk Lawyer, April 2006

Written by Craig D. Robins, Esq.

Discusses criticism and controversy over various aspects of BAPCPA as provided by judges in written decisions, and by commentators.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

The New Credit Counseling Requirement: How to Deal with It, Cases Interpreting It, News About It, and Practical Tips

Suffolk Lawyer, March 2006

Written by Craig D. Robins, Esq.

Discusses basically everything you need to know about the controversial new credit counseling law.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

The 2005 Bankruptcy Amendment Act: Winners and Loser. Did the Credit Card and Banking Industries Get What They Bargained For?

Nassau Lawyer, March 2006

Written by Craig D. Robins, Esq.

Discusses who benefits from the new laws and who does not, ranging from consumers to secured lenders to trustees to bankruptcy attorneys to credit card companies.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Bankruptcy Update: The new Laws Are Not Popular

Suffolk Lawyer, February 2006

Written by Craig D. Robins, Esq.

Addresses criticism about the new bankruptcy laws from attorneys, trustees and judges. Discusses the first local attorney sanctioned for neglecting to properly assist clients with the credit counseling requirement.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Attorney Advertising Under the New Bankruptcy Laws

Suffolk Lawyer, January 2006

Written by Craig D. Robins, Esq.

Discusses concept of attorneys as "Debt Relief Agencies" under the new laws and new requirements for bankruptcy attorneys who advertise.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Nine New Year's Resolutions Consumer Bankruptcy Practitioners Should Make

Suffolk Lawyer, December 2005

Written by Craig D. Robins, Esq.

Contains Craig's suggestions for how consumer bankruptcy attorneys can resolve to better their practice

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Consumer Bankruptcy Debtors Face New Limitations for Repeat Filings

Suffolk Lawyer, November 2005

Written by Craig D. Robins, Esq.

Discusses changes to the automatic stay for repeat filers under the new laws, as well as changes to the length of time between debtors must wait before being eligible for discharge in a new case.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Are You Ready for the New Bankruptcy Laws?

Nassau Lawyer, November 2005

Written by Craig D. Robins, Esq.

Addresses the essential concepts and issues concerning the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005, which went into effect in October 2005.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Bankruptcy Practice Under the New Laws

Suffolk Lawyer, October 2005

Written by Craig D. Robins, Esq.

Discusses the significant changes imposed by the new laws which went into effect this month.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Consumer Bankruptcy Practice is Now Totally Changed

The Attorney of Nassau County, October 2005

Written by Craig D. Robins, Esq.

Discusses the new bankruptcy laws and its effect on attorneys who practice consumer bankruptcy law.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Surprise Law Enactment – Homestead Exemption Increased

Suffolk Lawyer, September 2005

Written by Craig D. Robins, Esq.

Discusses increase in New York’s homestead exemption from $10,000 to $50,000, legislative background and practical tips.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Protecting Your Client from Creditors Who Ignore the Discharge

Suffolk Lawyer, June 2005

Written by Craig D. Robins, Esq.

Discusses sanctions that can be awarded by the bankruptcy court against creditors who violate the order of discharge.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Will the New Bankruptcy Laws Effectively Prevent You From Continuing Your Consumer Bankruptcy Practice?

Suffolk Lawyer, May 2005

Written by Craig D. Robins, Esq.

Discusses the difficulties consumer bankruptcy practitioners will face under the harsh new laws, considering the law’s complexity, its new due diligence requirements, and sanctions for violations.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Consumer Bankruptcy: Bankruptcy Reform is Finally Here. Get Your Clients to File Now!

Suffolk Lawyer, April 2005

Written by Craig D. Robins, Esq.

Discusses the urgency for consumer bankruptcy practitioners to get their clients to file for bankruptcy relief before the harsh new bankruptcy laws become effective in October 2005.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

What Happens If Your Personal Injury Client Files for Bankruptcy

Nassau Lawyer, April 2005

Written by Craig D. Robins, Esq.

Addresses issues facing a plaintiff’s personal injury attorney when their personal injury client files for bankruptcy, and reviews bankruptcy fundamentals that negligence lawyers should be aware of.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

You Better Hurry Up and File Those Bankruptcy Petitions

The Attorney of Nassau County, April 2005

Written by Craig D. Robins, Esq.

Discusses the enactment of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005, signed into law on April 20, 2005, which will become effective in October 2005.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Consumer Bankruptcy: Discharging Gambling Debts: 10 Points to Know

Suffolk Lawyer, March 2005

Written by Craig D. Robins, Esq.

Discusses concepts involved with discharging gambling debts in consumer bankruptcy cases and helping clients who have gambling debt problems.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Consumer Bankruptcy: Five Bankruptcy Practice Pointers to Deal with the Effects of the Real Estate Boom

Suffolk Lawyer, February 2005

Written by Craig D. Robins, Esq.

Discusses several concepts that the bankruptcy practitioner should consider with today’s booming real estate market, including issues involving which chapter to file, real estate valuations, aggressive Chapter 7 trustees, and non-bankruptcy options.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Ten Bankruptcy Fundamentals the Matrimonial Attorney Should Know

Nassau Lawyer, February 2005

Written by Craig D. Robins, Esq.

Discusses important bankruptcy concepts that the matrimonial attorney should know about bankruptcy. Note: The 2005 Bankruptcy Amendment Act has made some of the information in this article obsolete.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Bankruptcy: What the General Practitioner Should Know about Chapter 11 (Part 3)

Suffolk Lawyer, January 2005

Written by Craig D. Robins, Esq.

Conclusion of three-part article about Long Island Chapter 11 practice and procedure, with a discussion of claims and confirmation of the plan.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Is Bankruptcy As We Know It Almost Dead?

The Attorney of Nassau County, January 2005

Written by Craig D. Robins, Esq.

Discusses the vigorous efforts in Congress to drastically alter the Bankruptcy Code to make it more difficult for consumers to discharge their debts. Reviews some of the legislative activity over the prior six years to overhaul the bankruptcy laws.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Bankruptcy: What the General Practitioner Should Know about Chapter 11 (Part 2)

Suffolk Lawyer, December 2004

Written by Craig D. Robins, Esq.

Continuation of three-part article about Long Island Chapter 11 practice and procedure with this part containing a discussion of some initial procedural issues, the debtor's chapter 11 obligations, and chapter 11 motions practice.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Real Estate Financing Options for Your Bankruptcy Clients

The Attorney of Nassau County, December 2004

Written by Craig D. Robins, Esq.

Discusses what types of mortgages that debtors emerging from bankruptcy can qualify for, and how Chapter 13 debtors who are still in a pending case can refinance.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Bankruptcy: What the General Practitioner Should Know about Chapter 11 (Part 1)

Suffolk Lawyer, November 2004

Written by Craig D. Robins, Esq.

First part of a of three-part article about filing Chapter 11 bankruptcy on Long Island, with this part containing a discussion how Chapter 11 compares with other chapters, when Chapter 11 should be utilized, how the Chapter 11 attorney works, and what happens upon filing.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Defending Motions to Lift the Stay

Nassau Lawyer, November 2004

Written by Craig D. Robins, Esq.

Discusses the various court rules a mortgagee must adhere to in order to properly bring a motion to lift the stay, and reviews defenses that consumer debtors’ attorneys can bring to defend such motions.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Consumer Bankruptcy: Bankruptcy Crime Does Not Pay

Suffolk Lawyer, October 2004

Written by Craig D. Robins, Esq.

Discusses the increased efforts of the Office of the United States Trustee to investigate bankruptcy crime, with a highlight about some interesting bankruptcy cases involving bankruptcy crime.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Being Haunted by the Vampire Bankruptcy Bill: It's Just Politics

Nassau Lawyer, October 2004

Written by Craig D. Robins, Esq.

Discusses the history of the past seven years of legislative efforts in Congress to change and reform the bankruptcy laws.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Judge Judith Kaye is Honoree at Theodore Roosevelt Inn of Court Annual Dinner. New York's Highest Judge Honored by Local Attorneys

Nassau Lawyer, October 2004

Written by Craig D. Robins, Esq.

Details Chief Judge Judith S. Kaye of the New York State Court of Appeals, who was the honoree at the 2004 annual Theodore Roosevelt Inn of Court Dinner hosted by Craig D. Robins.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Consumer Bankruptcy: Bankruptcy has Become a Middle Class Phenomenon

Suffolk Lawyer, September 2004

Written by Craig D. Robins, Esq.

Discusses recent findings that those people who are most likely to file for consumer bankruptcy are middle-class families of the baby-boomer generation, which is the typical Long Island family.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Everything That Can Go Wrong With the Meeting of Creditors. Part Three: More Problems and Dilemmas

Suffolk Lawyer, June 2004

Written by Craig D. Robins, Esq.

Conclusion of a three-part article containing valuable practice pointers for resolving common problems that can come up at the meeting of creditors, also known as the section 341 hearing.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

A Primer on Adversary Proceedings

Nassau Lawyer, June 2004

Written by Craig D. Robins, Esq.

Addresses the various types of law suits called adversary proceedings that can be brought within a consumer bankruptcy case including objections to discharge.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Everything That Can Go Wrong With the Meeting of Creditors. Part Two: Issues with the Trustee

Suffolk Lawyer, May 2004

Written by Craig D. Robins, Esq.

Continuation of a three-part article containing valuable practice pointers for resolving common problems that can come up at the meeting of creditors, also known as the section 341 hearing, with a focus on issues involving the trustee.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Everything That Can Go Wrong With the Meeting of Creditors. Part One: Common Problems

Suffolk Lawyer, April 2004

Written by Craig D. Robins, Esq.

Beginning of a three-part article containing valuable practice pointers for resolving common problems that can come up at the meeting of creditors, also known as the section 341 hearing.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Consumer Bankruptcy: Handling the Emergency Filing

Suffolk Lawyer, March 2004

Written by Craig D. Robins, Esq.

Discusses the issues involved with filing a bankruptcy petition on an emergency basis.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Nine Tips to Protect Your Clients From the U.S. Trustee Initiative Program

Nassau Lawyer, March 2004

Written by Craig D. Robins, Esq.

Addresses a new objective of the U.S. Trustee’s Office to investigate and red-flag consumer bankruptcy cases for further review if they meet certain criteria which might be indicative of an abusive filing.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Consumer Bankruptcy: The 2004 Congress Moves Quickly to Toughen Bankruptcy Laws

Suffolk Lawyer, February 2004

Written by Craig D. Robins, Esq.

Discusses continued efforts of Congress to reform the bankruptcy laws and its effect on filing bankruptcy on Long Island.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

Consumer Bankruptcy Update

Suffolk Lawyer, December 2003

Written by Craig D. Robins, Esq.

Provides an update on various issues affecting Long Island bankruptcy filing such as the status of legislative action, new electronic case filing requirements, changes to bankruptcy forms, filing fee increases, and the U.S. Trustee Civil Initiative Program.

Full Story »

Text Version »

|

|

|

|

Full Story »  |

New Bankruptcy Legislation: A Rocky Road

Nassau Lawyer, December 2003

Written by Craig D. Robins, Esq.

Discusses the legislative history of the efforts of the bankruptcy reform movement over the past five years and examines the potential impact of bankruptcy reform on consumer bankruptcy practice.

Full Story »

Text Version »

|